Opendoor Surges More Than 60% After Naming a New CEO. Should You Buy OPEN Stock Here?

Opendoor (OPEN) shares soared over 70% on Thursday after the online real estate platform named Kaz Nejatian as its new chief executive. Nejatian has previously served at Spotify (SPOT) as COO.

In a press release this morning, the Nasdaq-listed firm also confirmed that co-founder Keith Rabois will return as its chairman while Eric Wu will rejoin the board as well.

Including today’s explosive rally, OPEN stock is trading up more than 1,700% from its year-to-date low.

Why Are Investors Content With Opendoor Stock?

Investors are cheering Nejatian’s appointment today because he brings comprehensive product and operational expertise to the San Francisco-headquartered company.

Nejatian’s appointment signals a pivot toward AI-driven innovation in real estate, with promises to make home buying and selling “radically simpler, faster, and more certain.”

Note that Eric Wu, together with Khosla Ventures, has agreed to a $40 million capital infusion into Opendoor Technologies as well which adds another layer of credibility to the firm’s commitment to future growth.

For OPEN shares, this leadership reboot feels like strategic reset, one that could pave the way for a successful turnaround.

Why OPEN Shares Remain Unattractive to Own in 2025

Despite the euphoria, Opendoor stock remains a high-risk bet for the second half of 2025.

The company’s fundamentals remain fragile with significant losses and a business model that’s highly sensitive to housing market cycles.

Plus, OPEN shares’ valuation seems rather stretched as well following a retail-driven surge that pushed its market cap from under $400 million to nearly $8 billion within months.

This meme-like behavior further adds volatility risk and makes Opendoor shares look even more disconnected from their intrinsic value.

In short, unless Opendoor proves it can generate consistent profits and scale artificial intelligence ambitions, OPEN stock may be more speculative than strategic.

How Wall Street Recommends Playing Opendoor

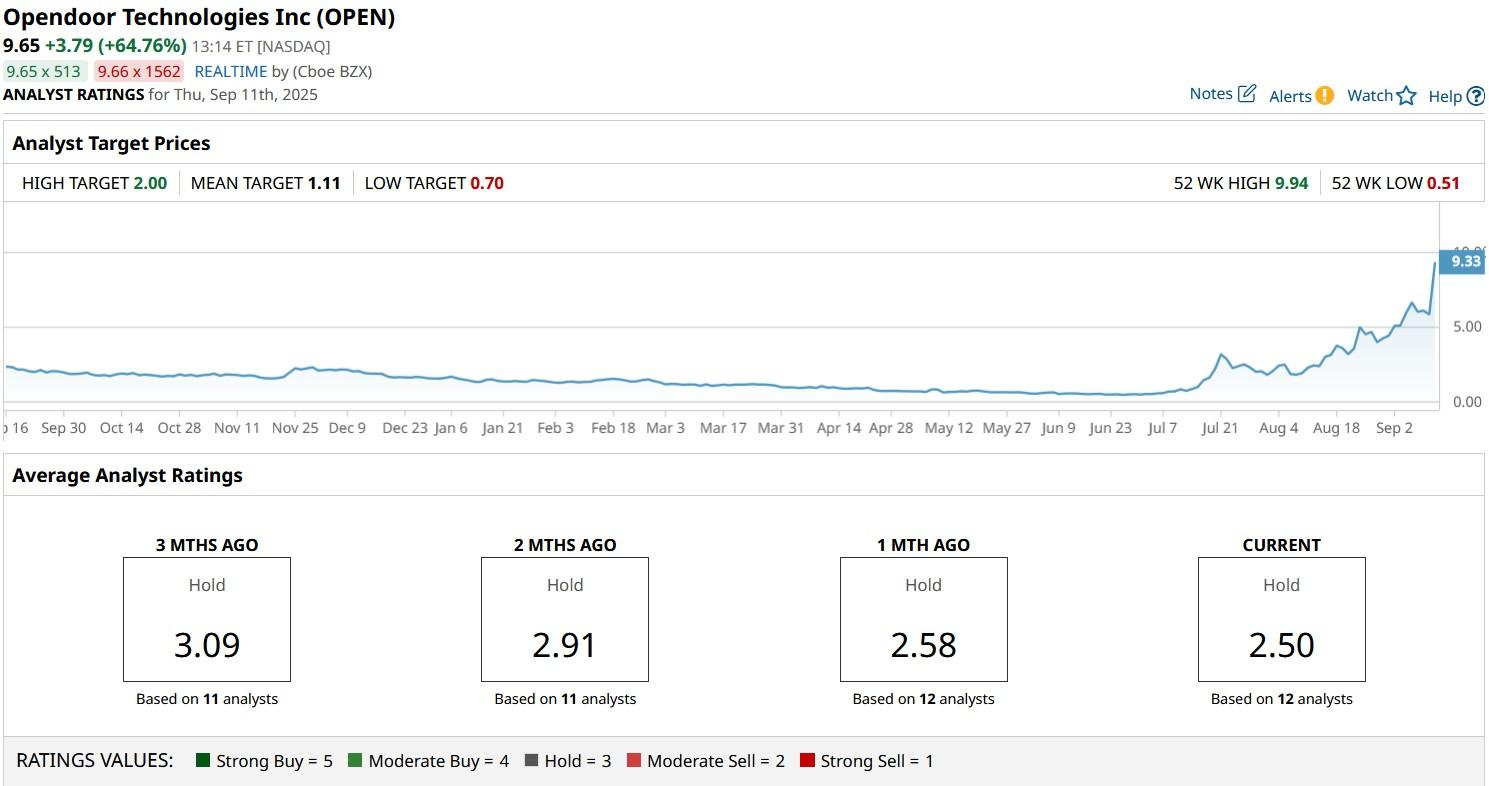

Investors should remain wary of owning Opendoor stock also because Wall Street currently has a consensus “Hold” rating only on the iBuyer.

More importantly, analysts’ mean target is pegged at $1.11 only, warning of a potential 90% crash in OPEN shares from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.